.

Pen-name Pig's amusing comments reminded me about Brinker's TEFQX and QQQQ buy-recommendations in 2000, and the fact that they are both still on "hold."

.

Here are some excerpts from what Pig posted in the comments section of my previous article:

.

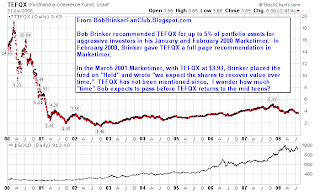

"Since 2003 , the Guru, Bob Brinker has been right 1 out of 3 calls.In the February 2000 Marketimer, Brinker devoted a full page to touting the Firsthand e-Commerce Fund.

The 2003 was a gem, the last two buys were a horrendous flop.

.

So I ask, why pay $185 for somebody that calls 33% of the time

correct?

.

All you need is a dirty old penny, and the experts will tell you that

you will be right 50% of the time, over a long span of time.

.

Now, some uppity shill is going to ask me, how would you know to buy

in 2003 on the exact day. So dopey me will answer, "Did you flip a

coin that day?" Of course they will tell me how stooopid I

am........but it will ring hollow, since the answer is no, and they

will never know the TRUTH.

.

They will then counter with "How does a coin tell you what to buy?"

.

And dopey me will answer "What did your Guru tell you to

buy? Doesn't he tell you to do your own due diligence and make your

own decisions?" Geesh..........that's the same advice that my penny

gives me.

.

I KNOW for a FACT that my penny will NEVER tell me to buy

TEFQX...........will never tell me to do a short term counter trend

rally trade (QQQQ 10 years??), nor tell me to buy some overpriced, now

defunct Montgomery Fund."

.

.

- From Paragraph 2: "...............Marketimer views Firsthand e-Commerce Fund as an excellent vehicle for the B2B investment. We expect the fund to maintain significant exposure to business-to-business related companies going forward."

- From Paragraph 4: "We believe e-Commerce fund manager Kevin Landis brings a high level of stock selection talent to the fund. .........We expect this fund to be in a position to exploit the explosive growth in the B2B area........"

- From Paragraph 8: "..........Due to our current risk adverse stock market stance, we are not placing this fund in any of our Model Portfolios at this time. Also, we would regard a five percent exposure to this fund as the maximum we would be willing to accept in the current difficult stock market environment................."

.

Brinker put TEFQX on HOLD in the March 2001 issue at $3.93 (a year after touting it), and has never mentioned it again.

.

TEFQX lost almost 90% of its value...see the graph below.

.

.